Your financial partnership is essential. Choose from several convenient giving options, including gifts of stock or real estate, one-time or recurring donations through our secure online portal, and legacy support through planned giving.

INFORMATION FILED WITH THE ATTORNEY GENERAL CONCERNING THIS CHARITABLE SOLICITATION AND THE PERCENTAGE OF CONTRIBUTIONS RECEIVED BY THE CHARITY DURING THE LAST REPORTING PERIOD THAT WERE DEDICATED TO THE CHARITABLE PURPOSE MAY BE OBTAINED FROM THE ATTORNEY GENERAL OF THE STATE OF NEW JERSEY BY CALLING (973) 504-6215 AND IS AVAILABLE ON THE INTERNET AT njconsumeraffairs.gov/charities/Pages/charities-registration-information.aspx. REGISTRATION WITH THE ATTORNEY GENERAL DOES NOT IMPLY ENDORSEMENT.

Gifts of Stock

A charitable gift of appreciated stock provides tax savings by allowing you to avoid capital gains tax you might incur with the sale of stock and may offer you a charitable deduction based on the stock’s current value. Contributions to Arm In Arm, a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code, are deductible to the fullest extent of the law. Gifts of securities received via DTC will be acknowledged using the mean value of the stock on the date it is transferred into Arm In Arm’s RBC account. Transfer to: RBC Capital Markets LLC; DTC # 0235; Account Number: 30249400; For credit to Arm In Arm ; Tax ID #: 22-3198464

Planned Giving

- Help to secure Arm In Arm’s future by designating a gift or portion of your estate with a bequest.

- Charitable Remainder Trust. You can place assets in a trust that pays annual income to you (or another named beneficiary) for life. After your lifetime or a term of years, the remainder of the trust can be transferred to Arm In Arm.

- Charitable Lead Trust. You can place assets in a trust that pays a fixed amount to Arm In Arm for the number of years you select. Once this period ends, the assets held by the trust are transferred to the beneficiaries you name.

- Retirement Plan/Life Insurance. You can name Arm In Arm as the designated beneficiary of a retirement plan or as the designated beneficiary, or partial beneficiary, of a life insurance policy.

- Charitable Planning with your IRA. If you are 70½ or older, and therefore required to withdraw monies from your IRA every year, a provision allows you to redirect your IRA contributions to charitable organizations like Arm In Arm.

- Real Estate – Please contact us to discuss a gift real estate or other property to Arm In Arm.

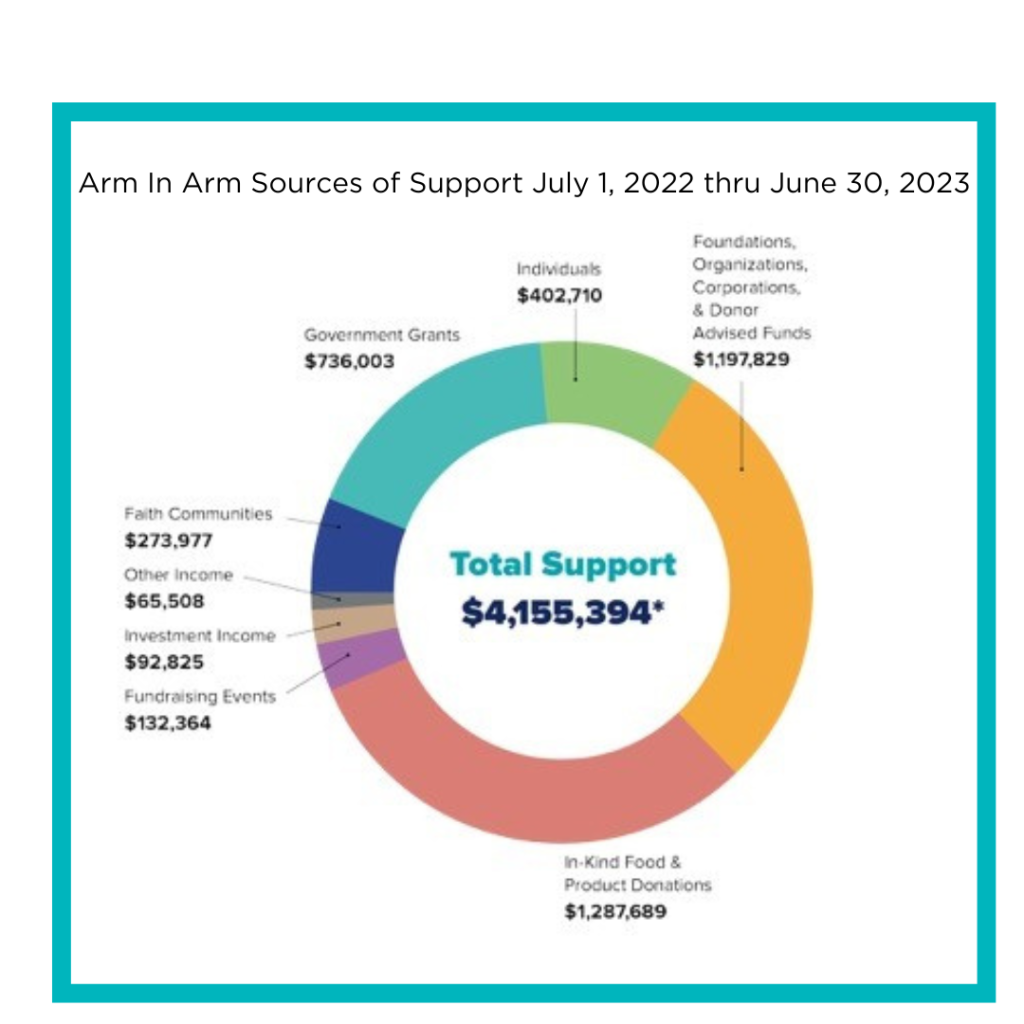

Click on the image to read our 2022-2023 Impact Report

Click on the image to read our 2022-2023 Impact Report

EARLIER ANNUAL REPORTS

2021-2022 2020-2021 2019-2020 2018-2019 2017-2018 2016 2015 2014 2013 2012

AUDITS 2025, 2024, 2023, 2022 , 2021, 2020, 2019 2018 2017 2016 2015 2014

FORM 990 FY2024 FY2023, FY2022 2020 2019 2018 2017 2016 2015 2014

AIA IRS 501(c)3 letter

2017 – 2019 Arm In Arm Strategic Plan

Document Retention and Destruction Policy

Policy for Employee Protection (Whistle Blower) Policy

Financial Statements June 30th, 2020

Financial Statements June 30th, 2021

Financial Statements, June 30th, 2022

Financial Statements, June 30th, 2023

Financial Statements, June 30, 2024

Financial Statements, June 30, 2025

Conflict of Interest Policy

Donor Privacy Policy

We thank the following organizations for their financial partnership in the last 12 months

Abiding Presence Lutheran Church Accenture The Alsdorf Foundation Bank of America Charitable Gift Fund BlackRock The Corella & Bertram F. Bonner Foundation Bright Funds Foundation Capital Health System Capital Health System Foundation Church & Dwight Church of St. David the King Coforge Inc. Cogentrix Energy Power Management, LLC The College of New Jersey Community Impact Grants Fund of the Princeton Area Community Foundation Cream Ridge Winery Inc. CSAA Insurance Group Delectabell Management Inc. Doll Family Foundation Ewing Covenant Presbyterian Church Fiduciary Charitable Foundation Robert & Paulette File Foundation First Presbyterian Church of Hamilton Square First Presbyterian Church of Plainsboro First Presbyterian Church of Trenton Fleet Street Wine Merchants Fund for Women and Girls of the Princeton Area Community Foundation | Garden State Tile Distributors, Inc. Genmab The Glenmede Trust Company Philip S. Harper Foundation The Gertrude L. Hirsch Charitable Trust Howard Azer & Associates P.A. The Jewish Federation of Princeton Mercer Bucks Jewish Community Foundation of Greater Mercer Jewish Community Foundation of Los Angeles Robert Wood Johnson 1962 Charitable Trust Lowell F. Johnson Foundation Johnson & Johnson Junior League of Greater Princeton Lawrence Township Community Foundation Lutheran Church of the Messiah McCaffrey’s Food Markets The Curtis McGraw Foundation Medidata The Merancas Foundation, Inc. Robert A. Mills Foundation Nassau Presbyterian Church National Philanthropic Trust NJM Insurance Group Northfield Bank Foundation Novo Nordisk Inc. Pennington Presbyterian Church Honey Perkins Family Foundation, Inc. Presbyterian Church of Lawrenceville Princeton Monthly Meeting of Friends Princeton United Methodist Church Princeton University Tiger Trot | Princeton Area Juniorettes Princeton Middle School PTO Princeton Hydro, Inc. Princeton Area Community Foundation Princeton Photo Workshop Provident Bank Foundation PSE&G Foundation Purnell Family Fund Remex, Inc. Rotary Club of Montgomery/Rocky Hill RSW Foundation The Charles & Elsie Ruben Foundation, Inc. Fred C. Rummel Foundation The George H. & Estelle M. Sands Foundation Schwab Charitable Fund The Carolyn Jane Scott Charitable Trust Secondhand Stories, LLC John Ben Snow Foundation & Memorial Trust St. Paul’s Catholic Church The Snowden Foundation The Starbucks Foundation The Ann E. Talcott Fund Tenacre Foundation Trenton Health Team Trinity Church, Princeton Unitarian Universalist Congregation of Princeton Dorothea van Dyke McLane Association Vanguard Charitable Vanguard Community Stewardship Walmart Foundation The Wawa Foundation |

Arm In Arm is a 501 (c) 3 charitable organization serving all who are in need regardless of age, race, gender, religious status, sexual identity, ethnicity, or national origin.

Arm In Arm will not sell, trade, or share any donor’s personal information with any other person or organization, nor send donor solicitation mailings or other communications on behalf of any other organization, unless a donor has expressed specific permission to do so.